What is “Quant Fund”?

Quant Funds are data-driven investment solutions. Instead of relying on emotional bias or predictions, they use mathematical models to:

Analyze markets

Identify opportunities

Select stocks

But what makes them powerful is how they analyze stocks. This brings us to Factor Investing— the science behind Quant Funds.

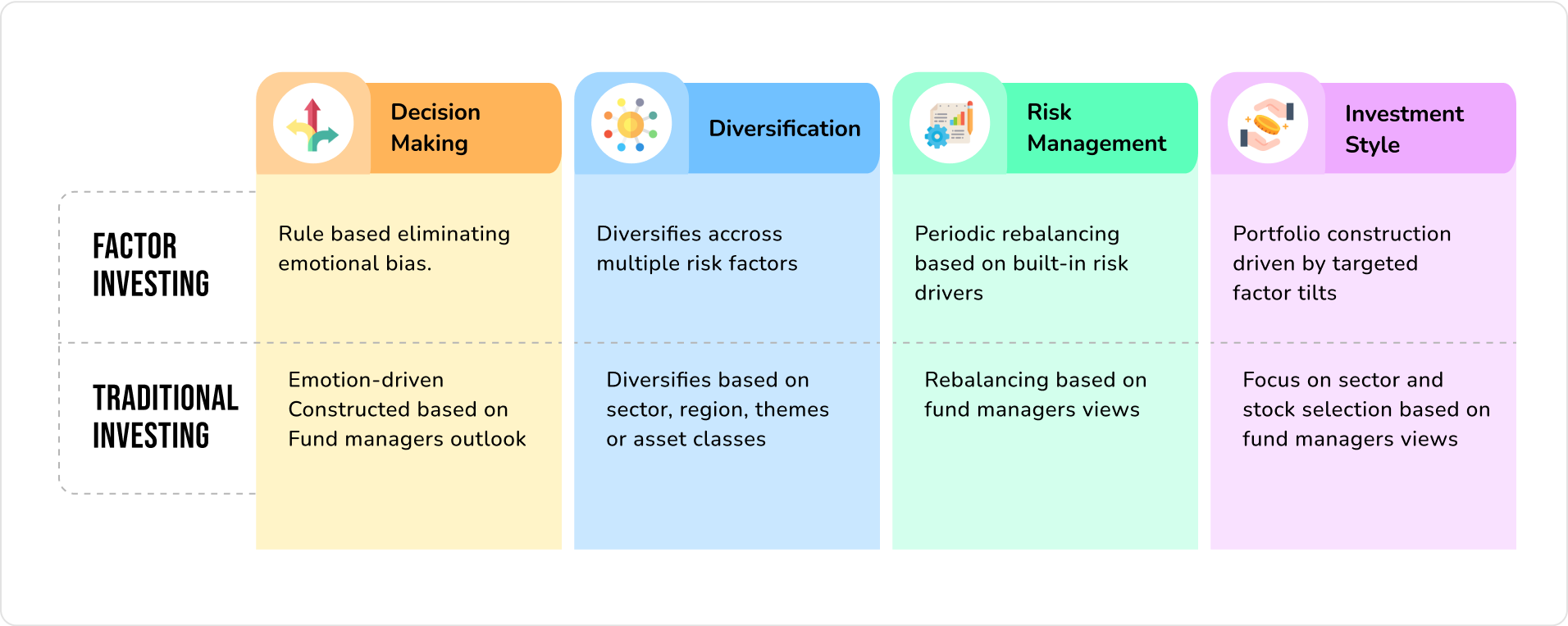

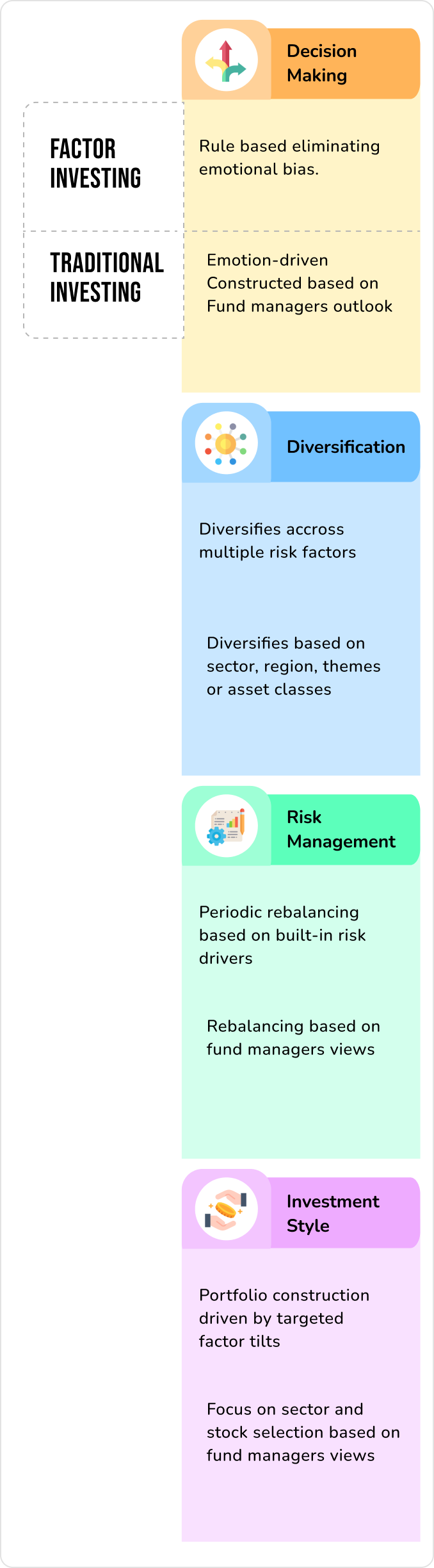

What is Factor Investing and How Does it Differ from Traditional Passive Strategies?

Investing isn't just about picking stocks—it's about understanding what drives returns. Factor investing focuses on specific traits like value, momentum, and quality to drive returns, while traditional investing emphasizes broad allocation across asset classes, regions, or sectors.

The Need To Have A Multi Factor Approach In Portfolio Construction

Cyclical nature of factors

Individual factors tend to perform in different market cycles, leading to periods of outperformance and underperformance.

Multi-factor Diversification

Combining multiple factors provides diversification, helping to smooth out the volatility of individual factor performance.

Enhanced Risk

Adjusted Returns: A multi-factor approach aims to deliver better risk-adjusted returns by balancing the strengths and weaknesses of different factors.

Reduced Drawdowns

Diversifying across factors can help in mitigating large drawdowns during market downturns.

Investment Ease

Multi-factor strategies simplify investing by integrating various factors, reducing the need for managing separate allocations.

SBI Quant Fund

SBI Quant Fund is an open-ended equity scheme following Quant based investing theme. The scheme shall seek to generate long-term capital appreciation by investing in equity and equity related instruments selected based on quant model theme. However, there is no assurance that the investment objective of the scheme will be achieved.

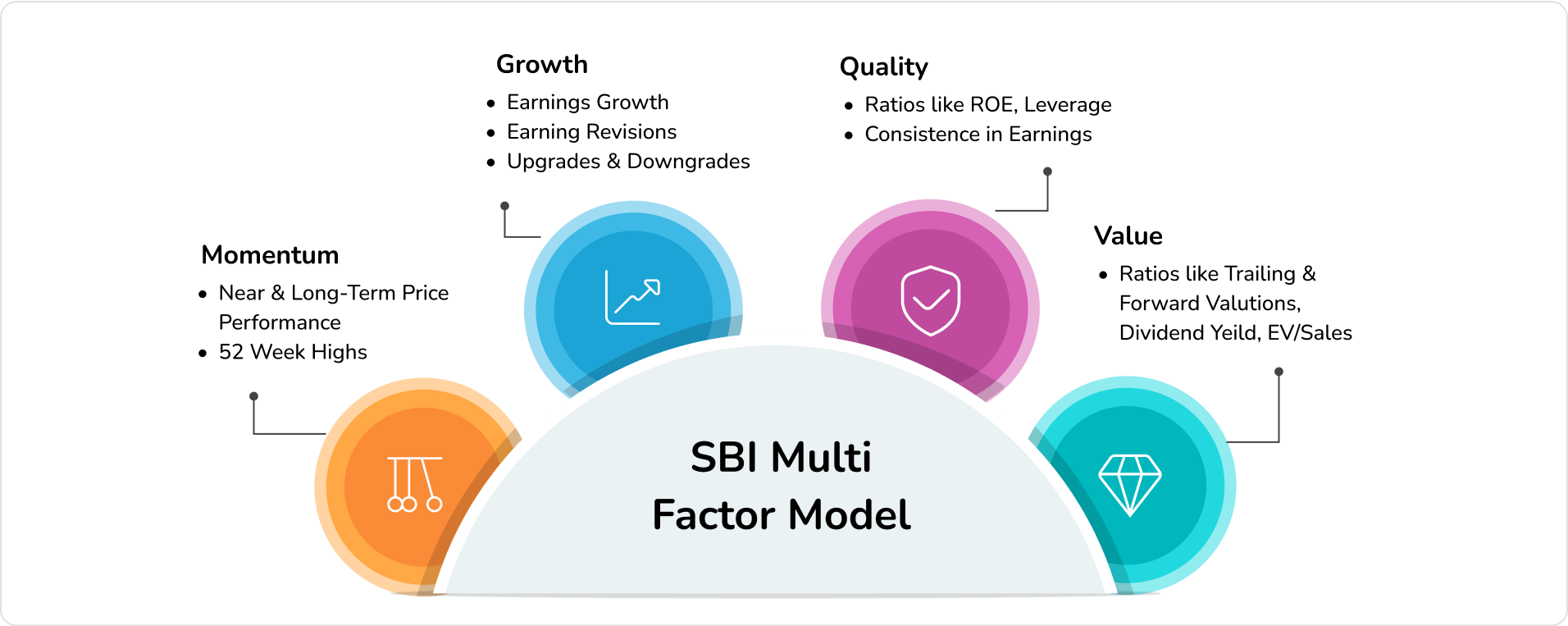

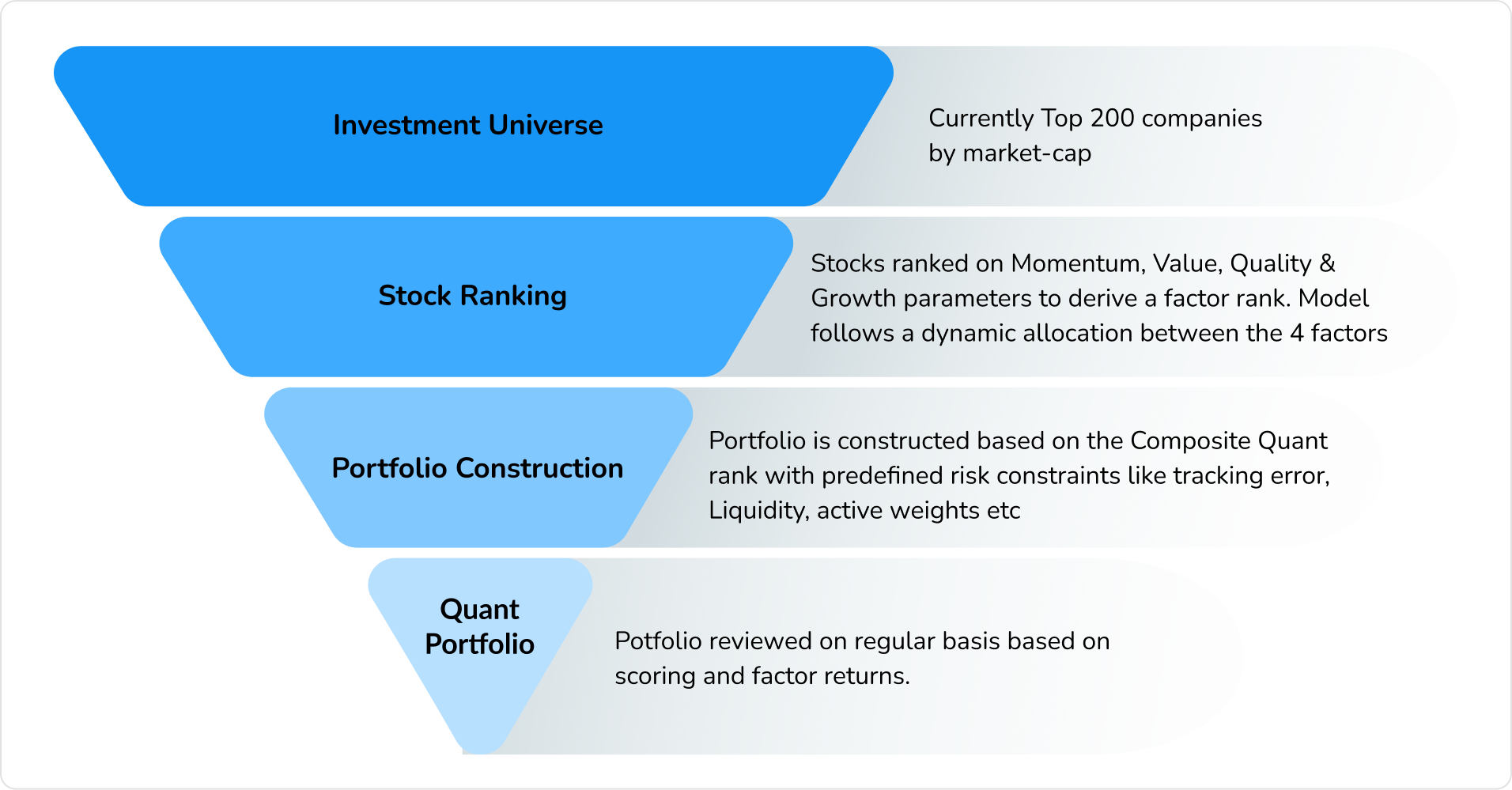

SBI Quant Fund follows the SBI Multi-factor Model

We use a multi-factor strategy, combining Momentum, Quality, Value and Growth to build a diversified portfolio that adapts to market cycles. By investing across multiple factors, it aims to balance returns and minimize the impact of individual factor shifts. The fund dynamically adjusts its allocation to favour the best-performing factors, reducing volatility and minimizing behavioural biases.

Our rigorously tested, multi-factor fund blends data-driven insights with proven market factors, adapting efficiently to real-world constraints like liquidity and sector limits. This balanced approach unites passive stability with active performance potential, offering investors a robust, growth-focused solution for long-term investment and effective risk management across varied market conditions.

Fund Facts

Scheme Name

SBI Quant Fund

Type of Scheme

An open-ended equity scheme following Quant based investing theme.

Investment Objective

The scheme shall seek to generate long term capital appreciation by investing in equity and equity related instruments selected based on quant model theme. However, there is no assurance that the investment objective of the scheme will be achieved.

Plans & Options

Regular & Direct Plan; Both plans provide two options - Growth Option and Income Distribution cum capital withdrawal (IDCW) Option

Fund Manager

Ms. Sukanya Ghosh Mr. Pradeep Kesavan is the dedicated fund manager for overseas securities

NFO Open

4th December 2024

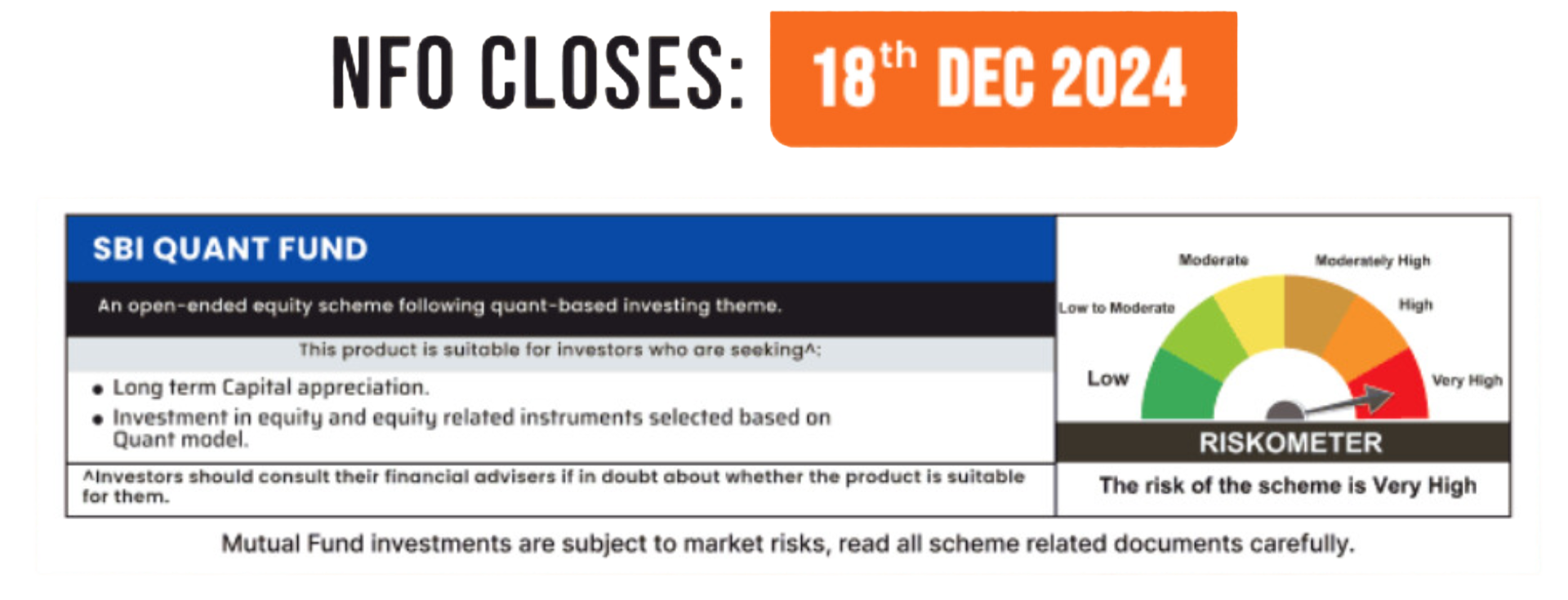

NFO Close

18th December 2024

Videos

Downloads

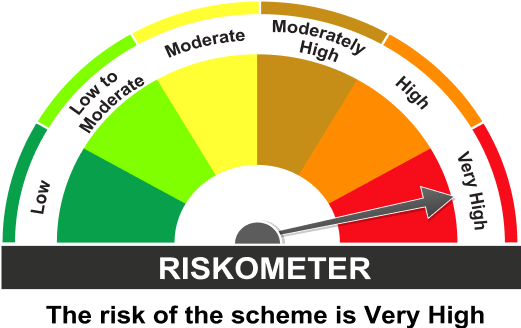

Product Label This product is suitable for investors who are seeking*

- Long term Capital appreciation

- Investment in equity and equity related instruments selected based on Quant model

*Investors should consult their financial advisors if in doubt whether the product is suitable for them.

Riskometer

SBI Quant Fund

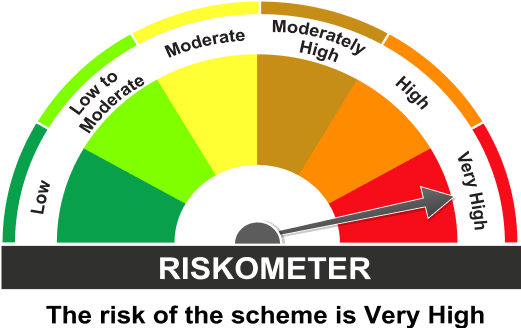

Benchmark Riskometer

BSE 200 TRI

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Contact Us

9th Floor, Crescenzo,C-38 and 39 G Block,Bandra-Kurla Complex Mumbai, Maharashtra India - 400051

customer.delight@sbimf.com

Privacy Policy

1800 209 3333 / 1800 425 5425 +91-22-2778 6551 (from outside India) +91-22-62511600 (from outside India)